|

| Order Michael Roberts' latest book |

It has now been eight years of what I have called a Long Depression, since the Great Recession started in January 2008 (see Recessions,depressions and recoveries 071215). So, in looking ahead to 2017, I thought it might be necessary to check what my forecasts or predictions were in previous years.

I have been accused of calling a new slump every year on the basis that eventually I’ll be right. That’s a bit like claiming that the time is midnight when it is not, but knowing that it eventually will be. So were my previous annual forecasts just parroting the view that a slump is just around the corner?

Well, at the end of 2011, I said that “2012 is likely to be another year of very weak economic growth in the major capitalist economies. But it is not likely to see a return of a big slump in capitalism.” At the end of 2012, I said “In 2013, economic growth in the major economies is likely to be much the same as in 2012 – pretty weak and below long-term averages. But 2013 is not likely to see a return of a big slump in capitalism.”

At the beginning of 2014, I said that “the change in profitability of capital in the US does not suggest a new recession in 2014. ”At the beginning of 2015, I reckoned that “The global economy remains in a crawl and will do so in 2015 for one good reason: the failure of business investment to leap forward. “

And at the beginning of this year (2016), I said “As for 2016, I expect much the same as 2015, but with a much higher risk of new global recession appearing….Even if a new global slump is avoided this year, that could be the last year that it is.”

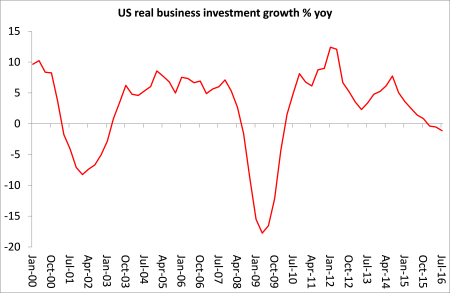

That brings me to 2017. When I made my 2016 forecast, the world economy seemed to be slowing down fast. The US economy was nearly at a standstill, Europe’s ‘recovery’ remained weak and Japan appeared to have entered a new recession. The US economy grew far less than expected in the second quarter of 2016. Real GDP (that’s the value of national production after inflation is removed) increased at only a 1.2% yoy rate. And US business investment fell at a 9.7% annual rate, the third straight quarterly fall. Japan failed to grow at all in Q2 2016, a sharp slowdown from 2% growth in Q1. And business investment there also collapsed. Eurozone growth was still stuttering. Above all, the talk was for a collapse in China’s economy because of excessive debt, bringing about an end to its miracle growth story. As Gavyn Davies, former chief economist at Goldman Sachs and now a columnist for the FT, recently described the economic mood at the beginning of 2016: “At the turn of the year, there were forecasts of global recession in 2016. ….It was a bleak period.”

But as the year went on, the imminent collapse of the Chinese economy proved to be wrong – something I did predict. Indeed, by the second half of the year, there were signs of a modest pick-up in growth as the Chinese authorities pumped more credit into the state banks and corporations and directed a modest expansion in fiscal spending.

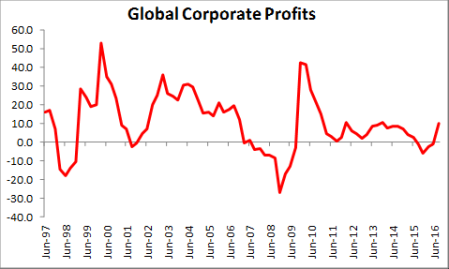

Now I have argued ad nauseam that it is the profitability of the capitalist sector of economies that is the driver of investment and thus employment and incomes. A sustained fall in profitability and in the mass of profits will eventually lead to a fall in investment after a year or so and then deliver a slump in the productive sectors of a capitalist economy, triggering in turn, a financial (credit) crisis. That appeared to be increasingly likely in the first half of 2016 as corporate profits and investment fell.

But in Q3, corporate profits in the major economies staged somewhat of a recovery back into positive territory and the major capitalist economies appeared to avoid a further slide down in growth towards zero. Corporate investment remains weak but if profits were to continue to rise, then investment too could pick up. JP Morgan seems to think so. In the past, the investment bank’s economists, like me, have highlighted the strong role profits played in driving the capital expenditure (capex) cycle. So “the recent stabilisation in global profit growth bodes well for capex, in this regard.” (JPM).

Financial markets in the last month or so have been buoyed by the possibility of a sustained economic recovery and also by the prospect of huge corporate tax cuts and infrastructure spending to be initiated by the new American oligarch president, Donald Trump, in 2017. And America’s households also seem more optimistic about 2017. The University of Michigan’s consumer sentiment index reached 98.2 in December 2016, the highest reading since January 2004.

This renewed optimism encouraged the US Federal Reserve in December to bite the bullet and risk raising its policy interest rate with aim of controlling credit and inflation, supposedly likely to rise next year. So everywhere, mainstream economists are now forecasting an acceleration in economic growth.

Gavyn Davies summed this up: “there has been a marked rebound in global activity, and in recent weeks this has become surprisingly strong, at least by the modest standards seen hitherto in the post-shock economic recovery….. the first time that all of the major economies have been growing at above trend rates for several years” So, says Davies, “Overall, we can perhaps be hopeful, though certainly not yet confident, that the global economy will begin to overcome the powerful forces of secular stagnation next year.”

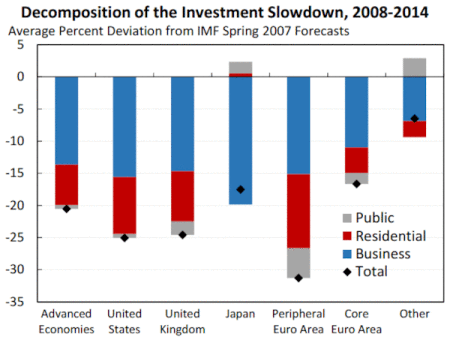

But is this optimism for 2017 justified? After all, every year since the end of the Great Recession in 2009, the main international economic agencies, the IMF, the OECD etc, have forecast a rise in GDP growth, trade and investment. And every year they have had to eat their words and revise their forecasts down. Investment in the major economies is now some 20% below where the IMF forecast it would be back in 2007.

But perhaps the agencies and economists are right this time and perhaps my forecast of a new slump (predicted by 2018 or so) is going to be proven wrong. Well, perhaps. But consider this. First, the so-called pick up in US economic growth is minimal. If the current forecasts of the final quarter of 2016 are realised, then the overall growth rate for 2016 in the US will be just 1.5%, the slowest annual growth rate since 2012. And growth in real GDP per person in 2016 will be the slowest since the Great Recession ended in 2009.

Second, much of this very modest growth has come from an expansion of household consumption and corporate borrowing (fuelled by very low interest rates and massive injections of credit). US mortgage rates are at an all-time low and the housing market is booming again. In Q3, personal consumption contributed two-thirds of the 3.5% (annualised) growth rate achieved by the US economy with trade and a build-up of stocks delivering the rest. Business investment contributed nothing.

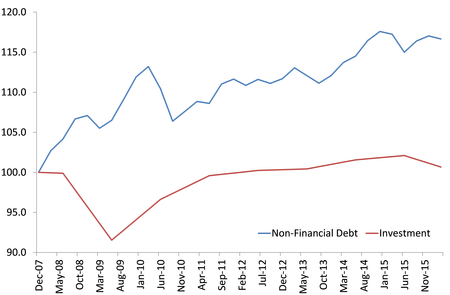

Global debt sales (half by corporations) reached a record in 2016, matching levels not seen since before the global financial crash. The money raised has gone into financial speculation, buying back company shares and in higher dividends to shareholders, thus boosting the stock and bond markets rather than productive investment.

But household consumption, although the largest part of national spending, does not drive growth. And if the cost of borrowing on credit cards and mortgages is now set to rise as the Fed continues to hikes its floor rate during 2017, as planned, then consumption growth could begin to fall back. The recovery in corporate profits is based on keeping productive investment and wages low (thus weakening productivity growth) and not on an expansion of investment, sales and revenues.

Moreover global growth is mainly coming from emerging economies like China (half of total growth). Only one-quarter is coming from the major capitalist economies, with the US, Europe and Japan making negligible contributions.

Globally, corporate debt levels continue to rise faster than productive investment. As the world’s leading bond investment company, PIMCO commented: “The low cost of financing with record-low interest rates simply made building up leverage tempting…This happens every economic cycle, but what makes this one special is the added incentive to issue debt at very low interest rates. (But) it sows the seeds of the next downturn or the next credit event.”

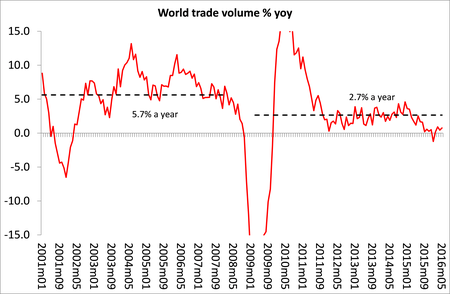

And there is now the prospect of more reductions in global trade as various international trade agreements bite the dust or flounder – while ‘the Donald’ talks of higher trade tariffs and walls.

One of the most graphic illustrations that the days of globalisation are over, making it more difficult for capitalism to get higher profits from the export of capital as profits fall at home, is the sharp fall in global capital flows – from over 25% of world GDP in 2007 to near zero now. Banks have stopped lending to other banks and taken their money back, while investors are increasingly reluctant to buy the corporate bonds of other countries.

Rising interest rates, along with still high corporate debt, sluggish world trade and poor business investment, do not look like a recipe for economic recovery in 2017. So 2017 will not deliver faster growth, contrary to the expectations of the optimists. Indeed, by the second half of next year, we can probably expect a sharp downturn in the major economies. Depending on whether this generates a new credit squeeze on weaker corporations and more pressure on banks. similar to that now being experienced in Italy, is difficult to judge.

But far from a new boom for capitalism, the risk of a new slump will increase in 2017.

No comments:

Post a Comment